Environmental Sustainability Dashboard - non-financial ESG reporting tool

New legal obligations for companies and the growing importance of sustainability issues are making non-financial ESG reporting an increasingly greater challenge for many companies. To streamline the processes of data collection, monitoring and analysis of ESG indicators, we have developed the Environmental Sustainability Dashboard – a combination of consulting service and ESG reporting tool.

ESG reporting - are you also responsible for it?

The obligation for non-financial ESG reporting was introduced by the CSR Directive. The legislation came into force in 2022. From 2024, many companies will be required to prepare annual ESG reports in accordance with the European Sustainability Reporting Standards (ESRS). The obligation for non-financial ESG reporting already applies to around 4,000 Austrian companies. In the coming years, it will be systematically expanded according to the following schedule:

- From 2024, public interest companies with a turnover of more than EUR 50 million and at least 500 employees will be affected,

- From 2025, all large companies or parent companies of large groups that meet at least 2 of the following criteria will be affected : turnover of at least EUR 50 million, more than 250 employees, balance sheet total of at least EUR 25 million,

- From 2026: Small and medium-sized listed companies that meet at least 2 of the following criteria: a balance sheet total of at least EUR 5 million and sales revenues of at least EUR 10 million for small companies or a balance sheet total of at least EUR 25 million and sales revenues of at least EUR 50 million for medium-sized companies.

In the environmental area, the ESG reports will include, among other things, data on greenhouse gas emissions, the company’s environmental impact and the status of the implementation of circular economy measures.

Preparing for non-financial ESG reporting with the Environmental Sustainability Dashboard

The Environmental Sustainability Dashboard is a consulting service that helps you prepare your company for mandatory ESG reporting. Our solution consists of ESG consulting tailored to the needs of our clients, supported by an online platform.

With the Environmental Sustainability Dashboard you can:

- Calculate your company’s most important environmental ESG factors for non-financial reporting

- Avoid financial penalties for non-compliance with ESG reporting obligations and reduce reputational risk for your company

- Identify in advance your company’s data that impacts the environmental ESG rating

- Gain time to implement measures that improve your company’s ESG rating and strengthen its position in the market

- Combine the data collected in the ESG report in the form of a clear digital dashboard

- Continuously monitor your company’s environmental KPIs

- Establish a new form of reporting on ESG factors that meets the requirements of the company’s investors and business partners

- Reduce your company’s impact on the environment

Environmental Sustainability Dashboard - comprehensive ecological ESG advice

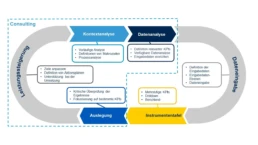

A key element of the Environmental Sustainability Dashboard is advice on preparing and compiling the data for the ESG report . Due to the volume and dispersion of this information, data selection and compilation can be time-consuming and lead to costly errors. Interzero offers comprehensive support in understanding and implementing the ESG standards, as well as advice on preparing an ESG report: from selecting the data scope to preparing the final document. To meet the highest reporting standards, the Environmental Sustainability Dashboard service consists of several carefully planned steps:

- Context analysis – a preliminary study of the context and business environment of the company,

- Data analysis – collection and configuration of input data, support in the selection of environmental KPIs,

- Data entry – preparation of an opening report in accordance with the requirements of the EU Taxonomy and CSRD with the possibility to take into account other international reporting standards and industry guidelines,

- KPI assessment – risk mapping, critical performance assessment and multidimensional analysis of the company’s actual environmental impacts,

- Improving the company’s environmental performance – developing a plan, setting short and long-term objectives,

- Support in the change process – consulting, ongoing adjustment of goals, environmental consulting.

Methods for calculating ESG indicators according to the CSRD

Your company’s ESG and sustainability indicators are calculated according to official international standards :

- Guidelines for Sustainability Reporting (GRI),

- Greenhouse Gas Protocol (GHG),

- Cumulative Energy Consumption (CED),

- Circulatory Index (MCI). The data is updated according to the respective ISO standard.

The methodology used complies with the requirements of the Corporate Sustainability Reporting Directive (CSRD) and the Sustainability Reporting Standards (ESRS). In addition, we offer a range of customized KPIs (emissions, energy, materials, waste, water).

ESD - a digital tool for ESG reporting

An integral part of the ESD service is a digital platform that allows you to track KPIs, monitor ESG factors and generate reports containing studies on your company’s non-financial data. The ESD platform dashboard contains dynamically published KPIs that can be displayed at different levels (management cockpit, key indicators, impact categories, KPI details).

The dashboard allows you to assign roles to employees (C-level, executives, marketing, managers, technical staff) and define access levels to the data.

Monitor your company's ESG and sustainability indicators

The Digital Dashboard consists of charts, graphs and tables containing the following information: key environmental indicators, information on the impact categories and detailed information on the indicators.

The data available in the tool is presented in a clear, graphical format that facilitates analysis and critical review of performance.

Create reports that comply with ESRS standards

From the dashboard you can create reports, including the development of KPIs:

- for a period of your choice,

- at group or country level,

- in .pdf or .xls format.

The scope of the report can be freely customized , for example by excluding certain report sections for internal use or by preparing a full ESG report for publication.

Grow your business with Interzero's Environmental Sustainability Dashboard

With the Environmental Sustainability Dashboard Service, you can make informed sustainability decisions for your company and learn how to effectively manage environmental issues. Interzero’s experts will guide you through the change process and support you in implementing measures to improve your company’s ESG rating.

What are the benefits of choosing the Environmental Sustainability Dashboard?

- You save costs by implementing circular solutions and using energy and other resources more efficiently.

- You win new customers by expanding your range of sustainable services and products.

- You come into contact with new business partners by meeting the ESG criteria.

- You increase the value of your company and your brand.

- They influence the perception of the company as a good employer, which makes it easier to recruit and retain employees.

- They make it easier for your company to access external financing and offer the possibility of obtaining preferential terms (e.g. lower costs) for loans or credits.

- They improve relationships with investors.

Why Interzero?

We are one of the leading providers of integrated environmental services. For more than 30 years, we have been helping companies to meet their legal obligations , take responsible steps in environmental protection and develop their business further. We advise, conduct environmental audits, take on reporting obligations and prepare environmental documentation. Our greatest asset is our qualified team of experienced specialists in the areas of air emissions, water and wastewater management, waste management and packaging. Already when introducing the ESG approach , we focus on the company’s environmental sustainability criteria and offer solutions that improve the ESG indicators in this area and have a positive impact on the company’s overall ESG rating. We have many years of experience in assessing the environmental impact of companies using an internationally standardized methodology. As part of our consulting, we support our clients in planning and implementing sustainable activities and provide them with innovative digital tools that automate a number of processes and minimize the risk of errors. In the future, we may also extend our advisory activities to the “S” (and “G”) components to enable the efficient preparation of holistic ESG reports.

The most frequently asked questions about non-financial ESG reporting in practice

Is non-financial reporting a new obligation for your company? Here you will find the answers to the most frequently asked questions about ESG in Austria.

ESG (Environmental, Social, Governance) is a set of indicators relating to the ecological and social responsibility of companies as well as to corporate governance issues. They form the basis for ratings and non-financial assessments of companies, countries and other organizations (e.g. NGOs). The individual ESG indicators and the overall ESG assessment of a company can be used to check whether and to what extent an organization is committed to sustainability, applies socially responsible business practices and creates benefits for all stakeholders (especially non-financial ones). The analysis of a company’s ESG strategy and ESG reporting is an important part of a company’s risk assessment, which is carried out, among other things, in mergers and acquisitions, by investors and, increasingly, by potential business partners.

An ESG report is an annual, non-financial report that contains information on a company’s activities in the three areas of environmental, social and governance, as well as the results of these activities. A well-structured ESG report should be guided by the guidelines contained in a number of (national, European and international) legal acts and organizational regulations, which include, among others:

- Accounting Act implementing the Directive on the disclosure of non-financial information

- Non-Financial Disclosure Directive (NFRD/CSRD)

- Financial Services Sustainability Disclosure Regulation (SFDR)

- EU Taxonomy Regulation

- Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

The ESG reporting requirement came into force on January 1, 2024. Since then, around 4,000 Austrian companies have had to submit a mandatory non-financial report every year. In the coming years, the ESG reporting requirement will be extended to more and smaller companies in the EU.

From 2024, the obligation to provide non-financial ESG reporting will be extended to large companies, so-called public interest entities or parent companies of large groups with more than 500 employees that meet one of the following criteria: net sales of more than EUR 40 million and/or total assets of more than EUR 20 million. In the following years, the non-financial reporting obligation will also be extended to smaller companies:

- from 2025: large companies or parent companies of large groups that meet two of the following criteria: more than 250 employees, net sales of more than EUR 50 million, balance sheet total of more than EUR 25 million,

- from 2026, small and medium-sized enterprises listed in the EU that meet two of the following criteria:

- For medium-sized enterprises: more than 10 employees, net sales of more than EUR 50 million, balance sheet total of more than EUR 25 million,

- For small enterprises: more than 10 employees, net sales of more than EUR 10 million, balance sheet total of more than EUR 5 million (deferrable until 2028),

- from 2028, certain non-EU companies with a net turnover in the EU of more than EUR 150 million and with an EU branch with a net turnover of more than EUR 40 million or an EU subsidiary subject to the CSRD.

The ESG indicators (also called ESG factors) can be divided into three main areas: environmental, social and governance. Examples of environmental ESG factors are:

- mitigating climate change

- adaptation to climate change

- Protection and sustainable use of inland and marine waters

- transition to a circular economy

- prevention and control of environmental pollution

- protection and restoration of biodiversity

Examples of social ESG factors include:

- The working conditions

- Health and Safety at Work

- Integration and Diversity in the Workplace

- development and training opportunities

- The level of respect for human rights

- relationships with the community

- Impact of the company / brand on consumers and end users

Examples of ESG factors related to corporate governance include:

- corporate culture and responsible corporate governance

- Use and functioning of corruption and bribery

- The company’s Austrian influence and lobbying

- relationships with suppliers and business partners

- data protection and data security